Trade Financing – How is it Different and Why Should You Know About It?

Trade Financing – How is it Different and Why Should You Know About It?

Trade financing can be a complex topic, but grasping its fundamentals can significantly boost your business’s growth. Let’s unravel what trade financing entails, how it differs from other financial options, and why it’s crucial for businesses today.

What is Trade Financing?

At its core, trade financing involves various financial instruments and products that facilitate international and domestic trade. It helps mitigate risks for importers and exporters by providing mechanisms like letters of credit, trade credit, and factoring. By ensuring that transactions proceed smoothly, trade financing plays a vital role in global commerce.

Types of Trade Financing

Letters of Credit (LCs): An LC is a guarantee from a bank that a buyer’s payment to a seller will be received on time and for the correct amount. If the buyer fails to pay, the bank covers the full or remaining amount.

Trade Credit: This is a credit arrangement between trade partners where the buyer can purchase goods and pay the supplier at a later date.

Factoring: Involves selling accounts receivables to a third party at a discount to obtain immediate cash flow.

Supply Chain Finance (SCF): This includes a set of solutions that optimize cash flow by allowing businesses to lengthen their payment terms to suppliers while providing the option for suppliers to get paid early.

Trade Financing vs. Supply Chain Finance

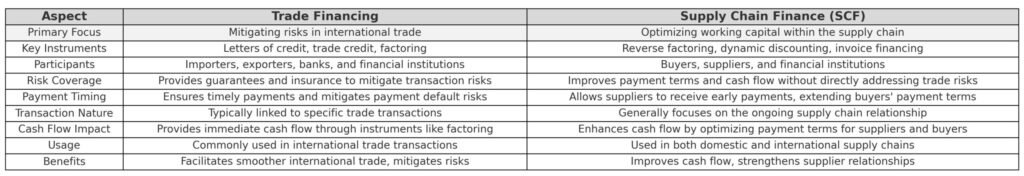

While trade financing and supply chain finance might seem similar, they serve distinct purposes:

Trade Financing: Primarily focuses on mitigating risks associated with international trade, ensuring that transactions proceed smoothly between global trading partners. It includes tools like letters of credit, trade credit, and factoring.

Supply Chain Finance: Optimizes working capital within the supply chain. It typically benefits both the buyer and the supplier by improving cash flow and reducing costs associated with the supply chain.

Importance of Trade Financing

Risk Mitigation: By providing guarantees and insurance, trade financing helps mitigate risks associated with international transactions.

Cash Flow Management: Businesses can manage cash flow better by leveraging instruments like trade credit and factoring, which provide immediate funds.

Growth Facilitation: Enables companies to enter new markets and expand their business by ensuring they have the necessary financial support.

Trust Building: Establishes trust between global trading partners through reliable financial backing.

How TurboCap Can Help

TurboCap offers a range of trade financing solutions designed to support businesses in navigating the complexities of international trade. By providing access to essential financial tools and expertise, TurboCap helps businesses mitigate risks, manage cash flow, and foster growth.

Key Takeaways

Trade financing involves various financial instruments that facilitate trade by mitigating risks and providing liquidity.

It differs from supply chain finance, which focuses on optimizing working capital within the supply chain.

Understanding and utilizing trade financing can help businesses manage cash flow, mitigate risks, and expand into new markets.

TurboCap provides essential trade financing solutions that support business growth and stability.

Turbo Capital FAQs

Trade financing primarily mitigates risks in international trade, while supply chain finance optimizes working capital within the supply chain.

A letter of credit is a guarantee from a bank that ensures the seller receives payment on time and for the correct amount if the buyer defaults.

It helps manage cash flow, mitigate risks, and facilitates business expansion by providing financial support for trade transactions.

TurboCap offers a range of solutions, including letters of credit, trade credit, and factoring, designed to support businesses in international trade.

Final Thoughts

Understanding trade financing and its benefits can significantly impact your business’s success in the global market. With the right financial tools and support from companies like TurboCap, businesses can navigate the complexities of international trade with confidence.