Unleash Growth using Supply Chain Financing Solutions

Dive into the world of supply chain financing solutions and learn how they can unleash business growth by improving cash flow, empowering suppliers, and enhancing operational efficiency.

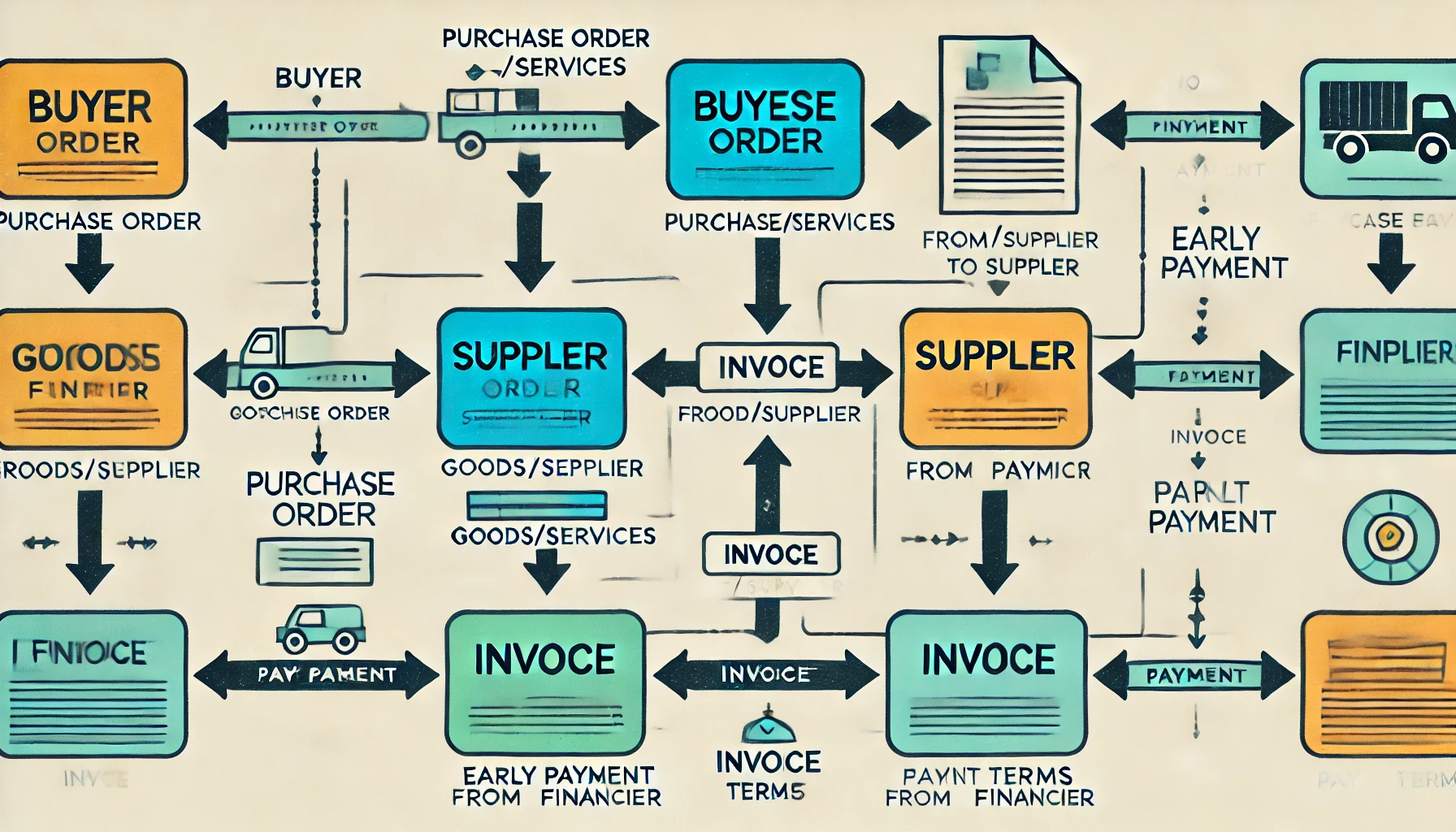

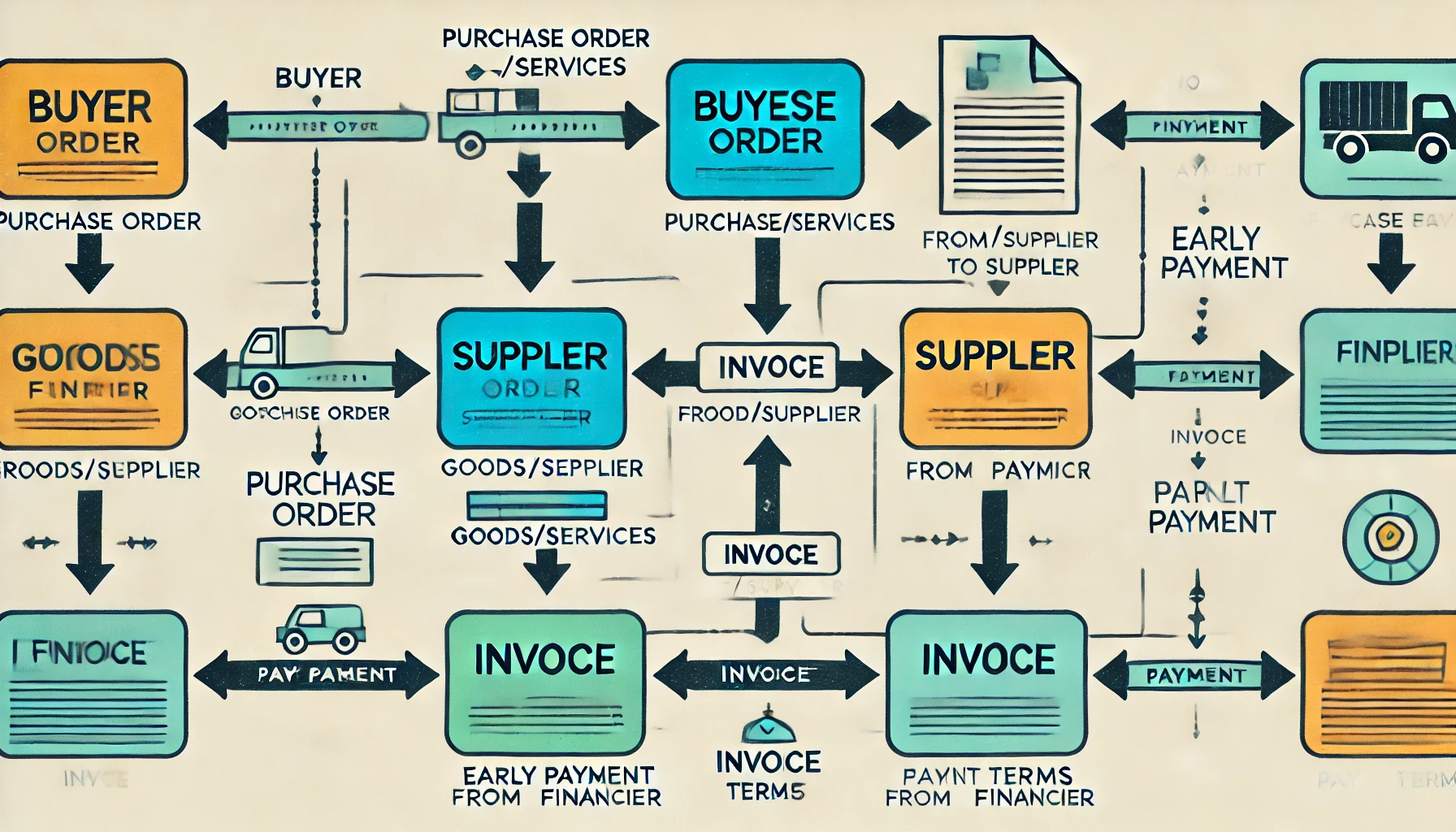

Supply chain and trade financing solutions

TurboCap offers market-leading terms and competitive pricing, empowering your business to thrive with cost-effective financial solutions.

Experience a smooth application process with TurboCap, where quick approvals and fast disbursals help you focus on growing your business.

Enjoy a transparent, secure process with TurboCap, ensuring you’re always informed and protected, with no hidden surprises.

Leverage our deep knowledge and experience in MSME and EXIM financing.

Benefit from quick, 48-hour loan disbursements to keep your business moving.

Access a range of tailored financial products to suit your unique business needs.

Enjoy consistent, robust customer support available 24/7 to assist you.

Providing capital and mitigating risks in international trade, unlocking capital from existing stock or receivables.

Bridging the working capital gap for suppliers by discounting unpaid invoices, ensuring continuous operations.

Covering expenses for importers while waiting for product delivery, bridging the gap between purchase and arrival.

Offering financing options to import-export platforms to support their clients with working capital.

Immediate payment for suppliers by discounting invoices, enhancing cash flow without waiting for due dates.

Selling outstanding invoices to financial partners, enabling quick cash flow and relieving the burden of collections.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Onboard on TurboCap Platform with your business details, and get closer to getting funds for your operational needs.

Step 1:

Sign up on TurboCap

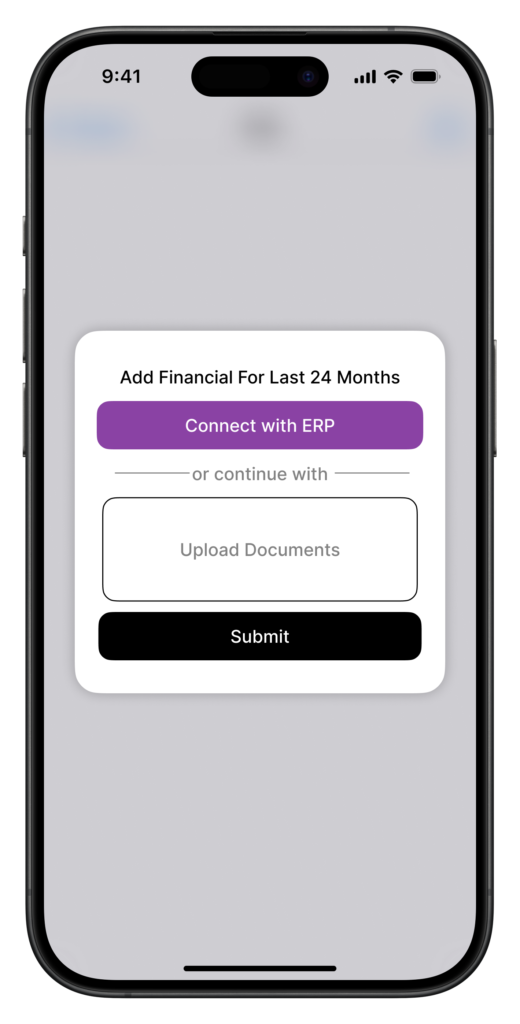

Step 2:

Sync your Financial Data

Provide us your balance sheets, income statements, and account statements with us. This will help us create customized growth financing solutions just for you.

Step 3:

Unlock Provisional Term Sheet within 48 hours

Get the initial term sheet from top 3 financing partners, and use the power to select the one that is most favourable to you.

We believe every business deserves the chance to grow and thrive. That’s why we connect you with a network of trusted financiers who provide tailored funding options that suit your unique needs. Whether it’s trade, export, import, or invoice financing, we’ve got you covered.

Our user-friendly platform makes it easy to find the right financial support to keep your business moving forward. We’re not just a service; we’re your partner in financial empowerment, committed to helping you achieve your business goals with confidence and ease.

At TurboCap, we envision a world where MSMEs thrive without financial barriers, driven by innovative and transparent solutions. We aim to be the leading force in transforming global trade by empowering businesses with seamless access to finance, fostering sustainable growth, and creating prosperous communities.

At TurboCap, we envision a world where MSMEs thrive without financial barriers, driven by innovative and transparent solutions. We aim to be the leading force in transforming global trade by empowering businesses with seamless access to finance, fostering sustainable growth, and creating prosperous communities.

TurboCap is a debt marketplace specializing in funding MSMEs in the EXIM space with supply chain financing products.

We offer quick, 48-hour loan disbursements once your application is approved.

TurboCap offers trade financing, export financing, import financing, embedded financing, bill discounting, and invoice factoring.

No, TurboCap provides collateral-free loans to eligible businesses.

Get insights to achieve financial success

100+ business owners have already subscribed

Dive into the world of supply chain financing solutions and learn how they can unleash business growth by improving cash flow, empowering suppliers, and enhancing operational efficiency.

Budget 2024-25 presents a renewed focus on providing financial support to MSMEs in India. From enhanced credit guarantee to increased Mudra loan limits, the government aims to empower small businesses

Reach out to TurboCap today to explore how our tailored financial solutions can empower your business growth.

WhatsApp us