Know Your Incoterms: A Quick Reference Guide for Global Merchants

Summary

Global trade is full of complex processes, and understanding the rules of international shipping can feel overwhelming. But one thing every merchant should know is how to navigate Incoterms®—the standardized terms that define the responsibilities of sellers and buyers in cross-border trade. Whether you’re just dipping your toes into the world of global trade or you’re a seasoned exporter, having a strong grasp of these terms can streamline your logistics and protect your business from potential risks. Let’s dive into the essentials of Incoterms® and what they mean for global merchants.

Introduction

Since 1936, Incoterms have been recognized as practical, cost-saving tools used worldwide to smooth international trading practices. When both parties (buyer and seller) specify the delivery according to Incoterms, it helps prevent disputes arising from that aspect of transactions.

What Are Incoterms?

Incoterms®, short for International Commercial Terms, are a set of rules established by the International Chamber of Commerce (ICC) to facilitate international trade. These terms define and regulate the responsibilities of sellers and buyers, costs, and risks associated with the global transportation and delivery of goods. First introduced in 1936, these terms have become the standard language of global trade, simplifying communication and reducing misunderstandings between trading partners.

They outline who is responsible for various parts of the shipping process, such as transport costs, insurance, duties, and customs clearance. This reduces the chances of disputes and ensures that both parties understand their obligations. The latest version of these terms was released in Incoterms® 2020.

Why Are Incoterms Important for Global Merchants?

As a global merchant, understanding and using the right Incoterms® can make or break your international deals. They allow you to clearly outline who bears the cost of transportation, insurance, and customs duties. They also clarify who is liable for risks such as damage or loss of goods during transit. Using the correct Incoterm in your contracts ensures smoother trade negotiations and reduces disputes.

Clarity and Communication: Incoterms provide a common language for traders, reducing misunderstandings in international transactions.

Risk and Cost Allocation: They clearly define who bears the risks and costs at each stage of the shipping process.

Legal Compliance: Incoterms help ensure legal compliance in international trade by clarifying customs duties and documentation responsibilities.

But, how do you know which Incoterm to use? Don’t worry—we’ve got you covered. Below, we’ll break down the most commonly used terms in simple language to help you decide which works best for your business.

Key Incoterms® Every Merchant Should Know

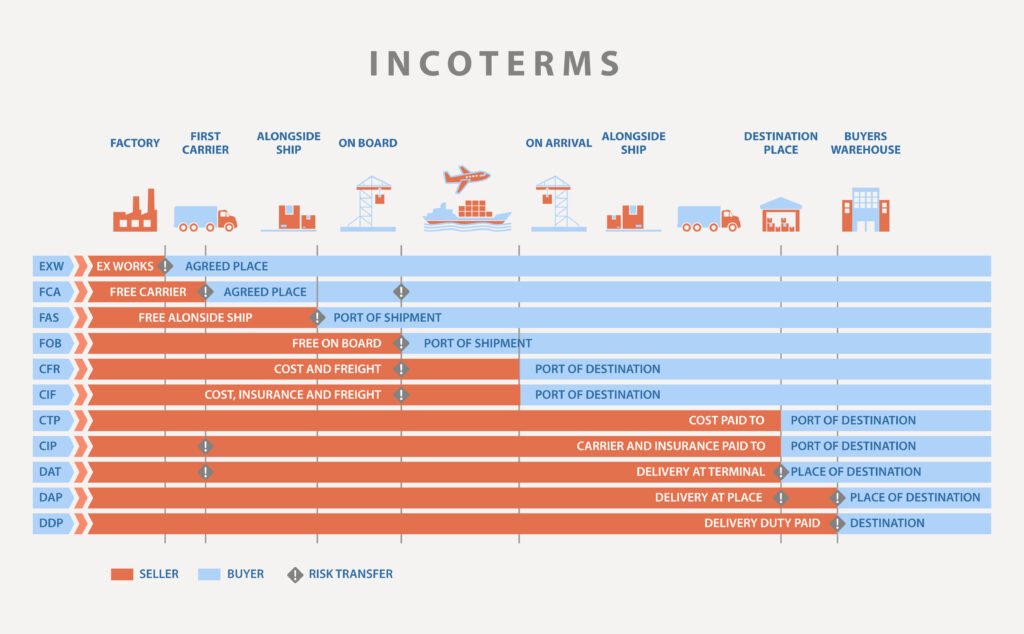

Incoterms are divided into two main categories based on the mode of transport:

Any Mode of Transport (Sea, Land, Air, or Rail)

Sea and Inland Waterway Transport

Additionally, the Incoterms can also be grouped into 4 categories – ‘E’ Term, ‘F’ Term, ‘C’ Term and ‘D’ Term – each represented by their starting alphabet.

Remember: Knowing Incoterms leads to Efficient Freight and Cargo Delivery (E.F.C.D)

‘E’ Terms – The seller only makes the goods available to the buyer at the seller’s own premises. The buyer is responsible for providing the carrier.

‘F’ Terms – The seller is called upon to deliver the goods to a carrier appointed by the buyer. The buyer is responsible for providing the carrier.

‘C’ Terms – The seller has to contract for carriage, but without assuming the risk of loss or damage to the goods or additional costs due to events occurring after shipment and dispatch.

‘D’ Terms – The seller has to bear costs and risks needed to bring the goods to the place of destination.

Let’s dive into the most commonly used Incoterms for each category (based on mode of transport).

Incoterms for Any Mode of Transport

EXW (Ex Works)

The prices quoted are for the goods at the seller’s premises, and the buyer bears all costs and risks involved (including packing) in taking the goods from the seller’s premises to the destination.

Seller’s Obligation: The seller makes the goods available at their premises (factory, warehouse, etc.).

Buyer’s Obligation: The buyer handles all costs and risks, including transportation, from the seller’s location to the final destination.

Best for: Buyers who want full control over the shipping process.

FCA (Free Carrier)

The seller delivers the goods, cleared for export, to the carrier nominated by the buyer at the named place. This can be used for any mode of transport, including multi-modal.

Seller’s Obligation: The seller is responsible for delivering the goods to a carrier or a location chosen by the buyer.

Buyer’s Obligation: Once the goods are handed over to the carrier, the buyer assumes all costs and risks.

Best for: Sellers who want to limit their responsibility to local transportation.

DAP (Delivered at Place)

Seller bears cost, risk, and responsibility of goods until made available at the buyer’s port.

Seller’s Obligation: The seller is responsible for delivering the goods to the buyer’s chosen location, excluding import customs clearance.

Buyer’s Obligation: The buyer handles customs duties and import procedures.

Best for: Buyers who prefer the seller to take care of most of the shipping process.

DDP (Delivered Duty Paid)

The seller delivers the goods when they are placed at the disposal of the buyer, cleared for import, on the arriving means of transport, ready for unloading at the named place of delivery.

Seller’s Obligation: The seller covers all costs, including shipping, insurance, and import duties, and delivers the goods to the buyer’s location.

Buyer’s Obligation: None, other than receiving the goods.

Best for: Buyers who want a hassle-free deal with all responsibilities covered by the seller.

Incoterms for Sea and Inland Waterway Transport

FAS (Free Alongside Ship)

The seller has to place the goods alongside the vessel on the quay or in the lighters at the named port of shipment. The seller pays all charges up to that point.

Seller’s Obligation: The seller delivers the goods alongside the buyer’s vessel at the port of shipment.

Buyer’s Obligation: The buyer is responsible for loading the goods, as well as all costs and risks from that point onward.

Best for: Buyers who manage their own shipping arrangements.

FOB (Free on Board)*

FOB prices comprise FOB Port Town plus charges incidental to actual shipment of goods, but minus ocean freight and marine insurance. The seller’s responsibility ends the moment the contracted goods pass the ship’s rail at the port of shipment named in the sales contract. The buyer bears all costs and risks of loss or damage to the goods from that point.

Seller’s Obligation: The seller is responsible for delivering the goods onto the ship chosen by the buyer.

Buyer’s Obligation: Once the goods are on board, the buyer assumes responsibility for all risks and costs.

Best for: Shipments where the buyer wants control after the goods are loaded.

CFR (Cost and Freight)

The seller must pay the costs and freight charges necessary to bring the goods to the named port of destination. The risk of loss or damage to the goods transfers from seller to buyer when the goods pass the ship’s rail in the port of shipment.

Seller’s Obligation: The seller covers the cost of shipping to the destination port.

Buyer’s Obligation: The buyer is responsible for insurance and all other costs once the goods are shipped.

Best for: Buyers who want the seller to cover shipping but manage the insurance themselves.

CIF (Cost, Insurance, and Freight)*

It’s the FOB price plus the cost of ocean freight and marine insurance up to the port of destination. Its a preferred type of quotation because the importer knows exactly what the goods will cost at their port.

Seller’s Obligation: The seller covers both shipping and insurance until the goods reach the destination port.

Buyer’s Obligation: Once the goods arrive, the buyer assumes all risks and costs.

Best for: Buyers who want the seller to handle shipping and insurance

Choosing the Right Incoterm for Your Business

Choosing the correct Incoterm depends on the nature of your business, your risk tolerance, and how much control you want over the shipping process. For instance:

If you prefer to control every aspect of your shipping process, go with EXW.

Want the seller to handle everything up to your doorstep? DDP is your best bet.

For buyers and sellers who want a middle ground where responsibilities are shared, FCA or FOB might be ideal.

Understanding these terms gives you a clearer idea of the obligations you are taking on in each deal, ensuring smoother transactions and avoiding costly mistakes.

Common Mistakes When Using Incoterms®

While Incoterms® are designed to simplify trade, some common mistakes can still occur:

Not specifying the exact location: Be clear on the delivery point. For example, if using FCA, specify the carrier’s warehouse.

Misunderstanding costs: Always clarify which party is responsible for duties, insurance, and transport charges.

Not updating to Incoterms® 2020: Some merchants still reference outdated terms, leading to confusion.

FAQs on eBRC

Turbo Capital FAQs

Incoterms® are standardized rules that define the responsibilities of sellers and buyers in international trade transactions, helping streamline global commerce.

They clarify who is responsible for transportation, insurance, customs, and risks in global trade, reducing disputes and misunderstandings.

In FOB, the buyer takes responsibility once goods are loaded on the ship, while in CIF, the seller covers shipping and insurance until the goods reach the destination port.

Wrapping It Up

Whether you’re just starting out in international trade or you’re expanding your reach globally, understanding Incoterms® is crucial for success. These rules help define the roles and responsibilities between buyers and sellers, ensuring everyone is on the same page from shipment to delivery.

By mastering these terms, you not only protect your business from risk but also streamline your global trade operations. So, take the time to review your contracts and select the right Incoterm for each deal.