Unleash Growth using Supply Chain Financing Solutions

Unleash Growth using Supply Chain Financing Solutions

Summary: This blog will delve into the concept of supply chain financing, its benefits for businesses, particularly in terms of cash flow optimization and supplier empowerment, and how implementing SCF can lead to significant growth and efficiency improvements. It will also cover different types of SCF solutions and provide practical tips for businesses looking to adopt these strategies.

Introduction

In today’s fast-paced business environment, maintaining a robust and efficient supply chain is paramount for success. One powerful tool that companies can leverage is supply chain financing (SCF). This financial strategy not only optimizes cash flow but also strengthens relationships with suppliers and fosters overall business growth. In this blog, we’ll explore the various ways supply chain financing solutions can help your business thrive.

What is Supply Chain Financing?

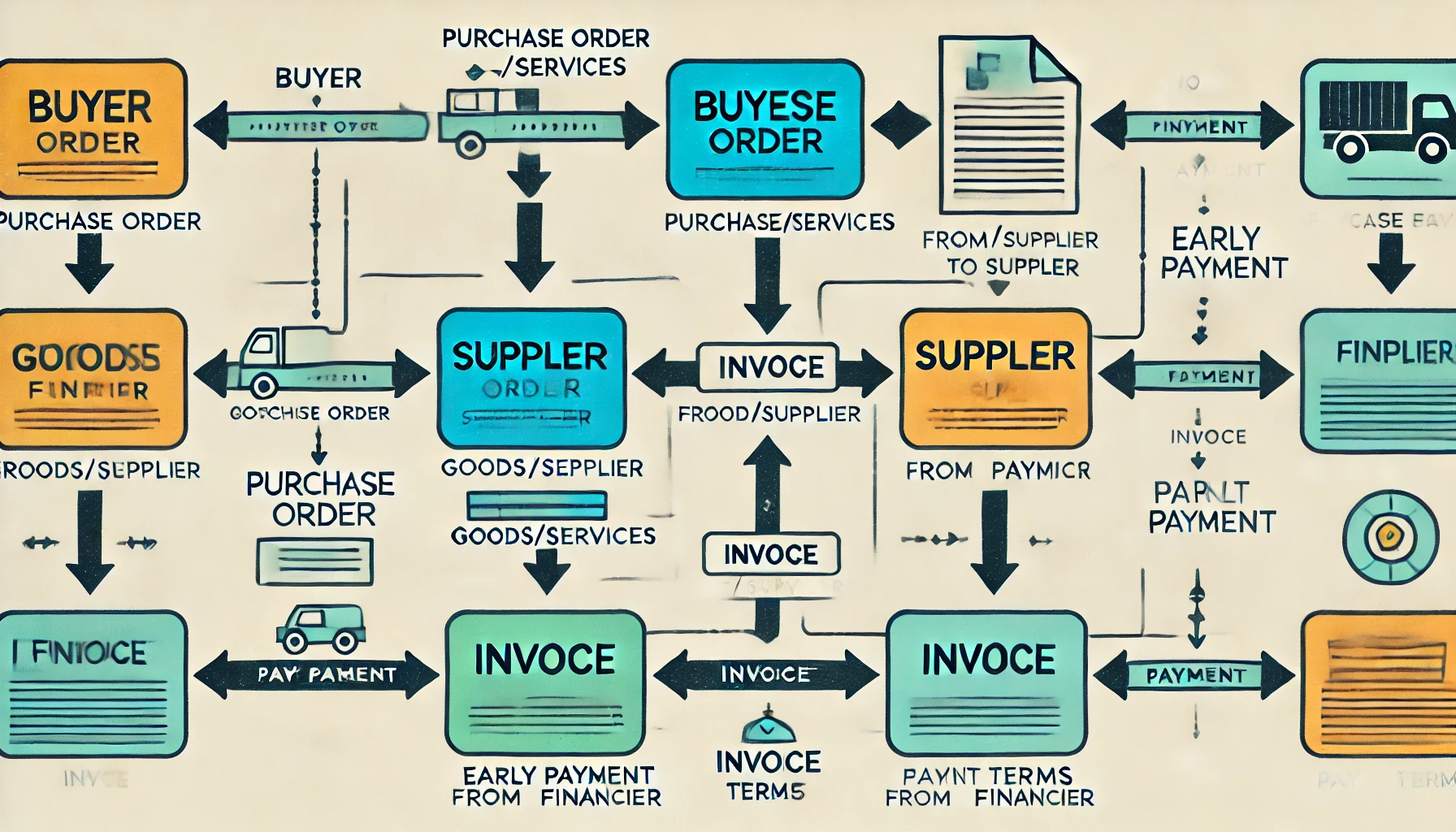

Supply chain financing (SCF) refers to a set of solutions designed to optimize cash flow by allowing businesses to extend their payment terms to suppliers while providing the option for suppliers to get paid early. This financial model bridges the gap between buyers and suppliers, ensuring liquidity and operational efficiency across the supply chain.

The Importance of SCF in Today's Business Landscape

In a world where businesses face constant financial pressures, supply chain financing emerges as a win-win solution for all stakeholders involved. Here are some of the critical reasons why SCF is crucial:

Cash Flow Optimization: SCF solutions help businesses manage their cash flow better by extending payment terms without straining supplier relationships.

Supplier Empowerment: By providing early payment options, SCF supports MSME suppliers who often struggle with cash flow issues, enabling them to grow and sustain operations.

Enhanced Operational Efficiency: With improved liquidity, businesses can invest in new opportunities, streamline operations, and reduce financial stress.

Types of Supply Chain Financing Solutions

Several SCF solutions cater to different business needs. Understanding these options can help businesses choose the right fit for their supply chain strategy:

Invoice Financing: Suppliers sell their invoices to a financier at a discount, getting immediate cash, while buyers get extended payment terms.

Reverse Factoring: Buyers work with a financier to pay suppliers early, often at a lower cost of capital, benefiting both parties.

Dynamic Discounting: Buyers offer early payment to suppliers in exchange for a discount on the invoice amount, enhancing mutual cash flow benefits.

Benefits of Implementing SCF Solutions

Implementing SCF solutions can unlock numerous benefits for businesses, including:

Improved Supplier Relationships: SCF strengthens relationships by providing suppliers with better cash flow, reducing the risk of supply chain disruptions.

Increased Negotiating Power: Businesses can negotiate better terms with suppliers when they know that payment won’t be an issue.

Access to Better Financing Rates: SCF often provides access to lower financing costs compared to traditional loans, improving overall financial health.

Scalability: SCF solutions can scale with the business, supporting growth without the need for additional financial burdens.

How to Implement Supply Chain Financing in Your Business

Adopting SCF solutions requires careful planning and collaboration. Here are some practical steps to get started:

Assess Your Supply Chain: Identify key suppliers and evaluate their financial health and cash flow needs.

Choose the Right SCF Solution: Based on your business model and supplier relationships, select an SCF solution that aligns with your goals.

Collaborate with Financial Institutions: Partner with banks or fintech companies that specialize in SCF to ensure seamless implementation.

Educate and Communicate: Clearly explain the benefits and processes of SCF to your suppliers to gain their buy-in and cooperation.

Monitor and Adjust: Continuously monitor the effectiveness of your SCF program and make necessary adjustments to maximize benefits.

Real-World Examples of SCF Success

Many businesses have successfully implemented SCF solutions and witnessed significant growth. For instance, companies in the automotive industry have used SCF to stabilize their supply chains, ensuring uninterrupted production. Similarly, retailers have leveraged SCF to support their suppliers, maintaining a steady flow of goods during peak seasons.

Challenges and Considerations

While SCF offers numerous benefits, it’s essential to be aware of potential challenges:

Initial Setup Costs: Implementing SCF solutions may involve upfront costs and resources.

Supplier Resistance: Some suppliers might be hesitant to adopt new financing models.

Regulatory Compliance: Ensure your SCF program complies with relevant financial regulations and standards.

Turbo Capital FAQs

The Enhanced Credit Guarantee Scheme provides term loans without collateral for manufacturing MSMEs, with a guarantee cover of up to ₹100 crore, reducing financial risks for lenders and facilitating access to capital.

The increased Mudra loan limit from ₹10 lakh to ₹20 lakh provides greater financial support for MSMEs, enabling them to expand their operations and meet working capital needs more effectively.

The budget offers subsidies and incentives for MSMEs to invest in digital tools and platforms, such as accounting software, inventory management systems, and online sales channels, enhancing operational efficiency and market reach.

The budget introduces a mechanism to ensure continued credit availability for MSMEs during financial stress, preventing them from becoming non-performing assets (NPAs) and helping them maintain operations and recover.

Reducing the turnover threshold for mandatory onboarding onto the TReDS platform facilitates better cash flow for MSMEs by enabling them to discount their trade receivables, ensuring quicker payment cycles.

By focusing on these key areas, Budget 2024-25 aims to create a robust ecosystem for MSMEs to flourish, driving economic growth and innovation across India

Final Thoughts

Supply chain financing solutions offer a strategic way to enhance business growth, optimize cash flow, and strengthen supplier relationships. By understanding and implementing the right SCF solutions, businesses can unlock new opportunities and achieve greater financial stability.

For more insights into supply chain financing and other financial strategies, reach out to TurboCap Experts and know more about how you can unlock growth from your supply chain.